3DNextech is happy to announce the closing of a new investment round!

The transaction sees EUREKA! Venture SGR, through the fund Eureka! Fund I – Technology Transfer, lead investor of the round alongside RoboIT, the Technology Transfer Hub for Robotics established by CDP Venture Capital SGR, the regional co-investment fund Toscana Next, established and managed by CDP Venture Capital SGR and underwritten by the main foundations of banking origin of the Tuscany Region (Fondazione CR Firenze, Fondazione Cassa di Risparmio di Lucca, Fondazione Caript, Fondazione Monte dei Paschi di Siena) to maximize investments in innovation for the territory, as well as a group of business angels. The transaction was completed through the coordination of the law firm Alpeggiani Avvocati Associati.

This round of financing is aimed at consolidating 3DNextech’s position in the market, further developing the company’s growth strategy that was created with the goal of replacing the concept of “mass production” with that of “mass customization” thanks to digital manufacturing, which allows for Km 0 production and thus reducing energy use and environmental impact. With a specific focus on 2024 and 2025, the future roadmap is based on the expansion of technological solutions, supported by the consolidation of the team and the strengthening of the partner network in Italy and abroad. In this context, the startup recently participated in the 2024 edition of CES in Las Vegas, the world’s most important tech event.

“It is a source of pride to have valuable partners by our side who show they believe in our mission and the solidity of our project,” explains Andrea Arienti, CEO and founder of 3DNextech. “Thanks to the strategic partnership with Eureka!, and the entry of new investors, we are ready to continue further along our development path: 2024 is the year in which the growth strategy takes concrete shape, with significant investments and collaborations with companies ready to take advantage of our innovative solutions. We aim to triple the current team, double revenues, and project ourselves into a new Series A round to be concluded in the first quarter of 2025.”

Andrea Arienti

What our partners say about us

“3DNextech, a spin-off from the Scuola Superiore Sant’Anna in Pisa, convinced us because of the solid foundation of scientific knowledge possessed by the team and its ability to exploit that know-how through the development of a patented technology and process capable of responding, in terms of greater sustainability, scalability and versatility of the proposed post-processing solutions, to the needs of a vast market composed of companies of various sizes and in different sectors,” says Anna Amati, partner at Eureka! Fund, who oversaw the investment.

“The technology developed by 3DNextech evolves the additive manufacturing landscape by equaling or even surpassing plastic products made through traditional industrial processes. Not only does this offer new opportunities for design and customization, but it also contributes significantly to environmental sustainability by reducing dependence on more polluting production processes,” comments Claudia Pingue, Technology Transfer Fund Manager at CDP Venture Capital. “With the RoboIT Hub, we will continue to closely monitor the progress of 3DNextech and offer our support to the path of this technology.”

Our Technology

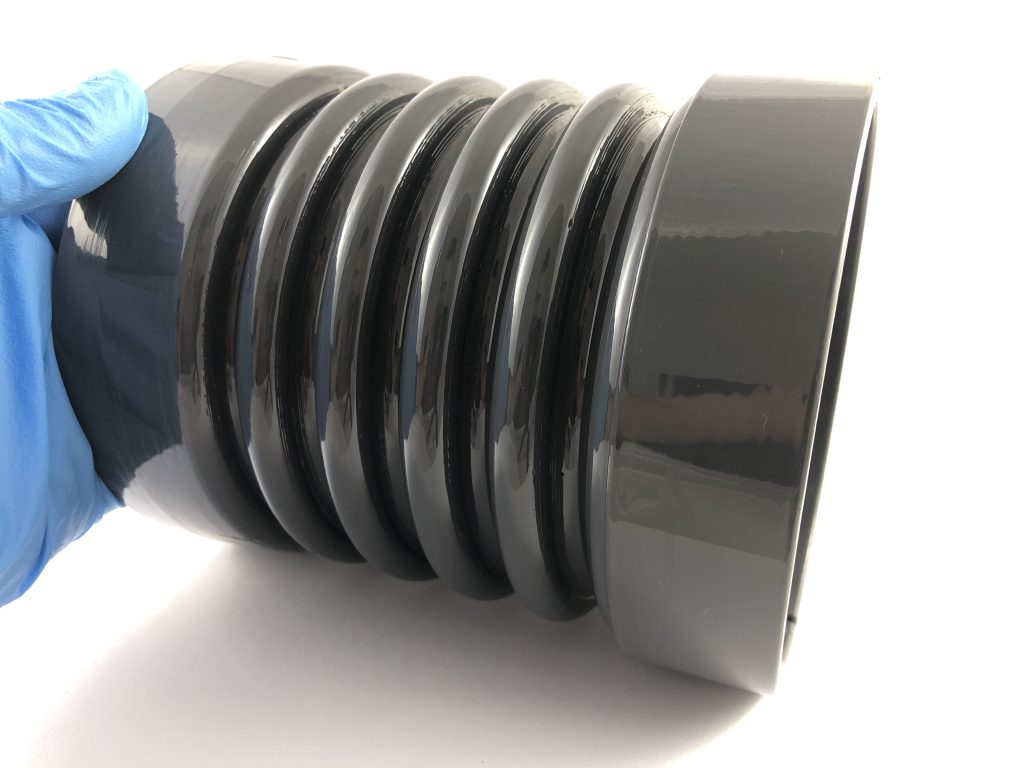

Using thermoplastic polymers such as ABS (Acrylonitrile butadiene styrene) or cellulose derivatives, three-dimensional creations often have small imperfections and ripples that make the surface rough and not very “pleasant” to the touch and eye. More importantly, they make the product lack the physical and mechanical characteristics that are essential for industrial and other uses, and make it comparable to those of products made by traditional methods. To solve this problem 3DNextech has developed a technology based on an innovative chemical-physical process and a large portfolio of patents, some already granted internationally (USA, China, Japan, Russia). Objects are processed in such a way as to make them malleable: the polymer chains of the plastic realign, and in finishing operations, the objects become shiny and strong, waterproof, and ready to be painted or metallized.

In addition to giving mechanical advantages to individual products, 3DNextech technology enables a whole new supply chain for the production of plastic objects, because products of a quality comparable to injection molding can be obtained but produced only in the necessary quantity and directly “on site.” The first device to integrate this technology is 3DFinisher, the finishing station to be used as a complement to a 3D printer that is able to “smooth out” imperfections in the object and return a product finished in every single aspect. The fields of application of this technology are the most varied, from automotive to design, from marine to medical.

Some milestones

Founded as a spin-off from the Scuola Superiore Sant’Anna in Pisa, 3DNextech immediately specialized in the development of products and technologies related to the world of additive manufacturing and 3D printing. The entry of the first business angel allowed the company to take its first steps, but the turning point came first with the entry of A11 Venture with a strategic capital increase, which allowed it to further expand its research and development horizons. Then with the entry of CDP Venture Capital SGR, which through a Relaunch Fund conversion recognized and supported the value and strength of the 3DNextech project, helping to build even more fertile ground for innovation. Recently Electrolux, a leading manufacturer of home appliances, chose to include 3DNextech as one of their additive manufacturing partners in their acceleration program at the Innovation Factory in Porcia.

EUREKA! Venture SGR

EUREKA Venture SGR is an independent Venture Capital firm licensed by the Bank of Italy and focused on deeptech investments, i.e. deep science investment and digital tech investment. The company manages €110M: the first Alternative Investment Fund, “Eureka! Fund I – Technology Transfer,” was launched in July 2020 and invests in proof-of-concepts, spin-offs, startups and companies aimed at exploiting the results of Italian scientific research activity in the field of Advanced Materials and more generally Materials Science and Engineering. The second Fund, BlackSheep Fund, launched in August 2021, invests in digital technologies such as AI and big data applied to the MadTech (Marketing & Advertising) sector.

For more information www.eurekaventure.it

RoboIT

RoboIT is the National Technology Transfer Hub for Robotics and Automation, established on the initiative of CDP Venture Capital with the aim of enhancing the results of Italian scientific and technological research by supporting the birth of startups conceived in the laboratories of Universities and Research Centers of excellence. The Hub was created in collaboration with the Italian Institute of Technology (IIT) in Genoa and involves as Scientific Promoters the University of Naples Federico II, the University of Verona, and the Scuola Superiore Sant’Anna in Pisa, among the leading Research Centers in Italy specializing in the field. Also part of RoboIT are Pariter Partners, as an entrepreneurial partner as well as co-investor, and corporate partner Leonardo.

For more information www.roboit.it

CDP Venture Capital SGR

CDP Venture Capital is an asset management company owned 70% by CDP Equity and 30% by Invitalia, created with the aim of making Venture Capital a backbone of the country’s economic development and innovation, creating the conditions for an overall and sustainable growth of the entire innovation ecosystem. CDP Venture Capital manages 13 of investment funds, amounting to more than €3 billion in resources that support innovative companies at all stages of their life cycle, making both direct and indirect investments (funds of funds).

For more information www.cdpventurecapital.it